A Local Partnership for all your Business Needs.

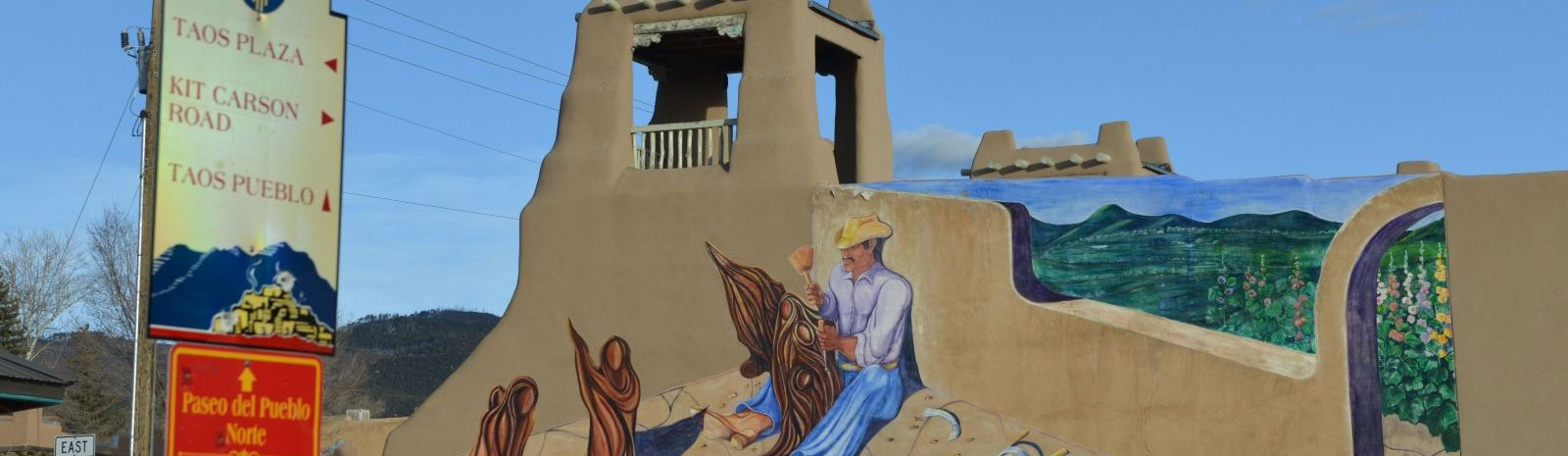

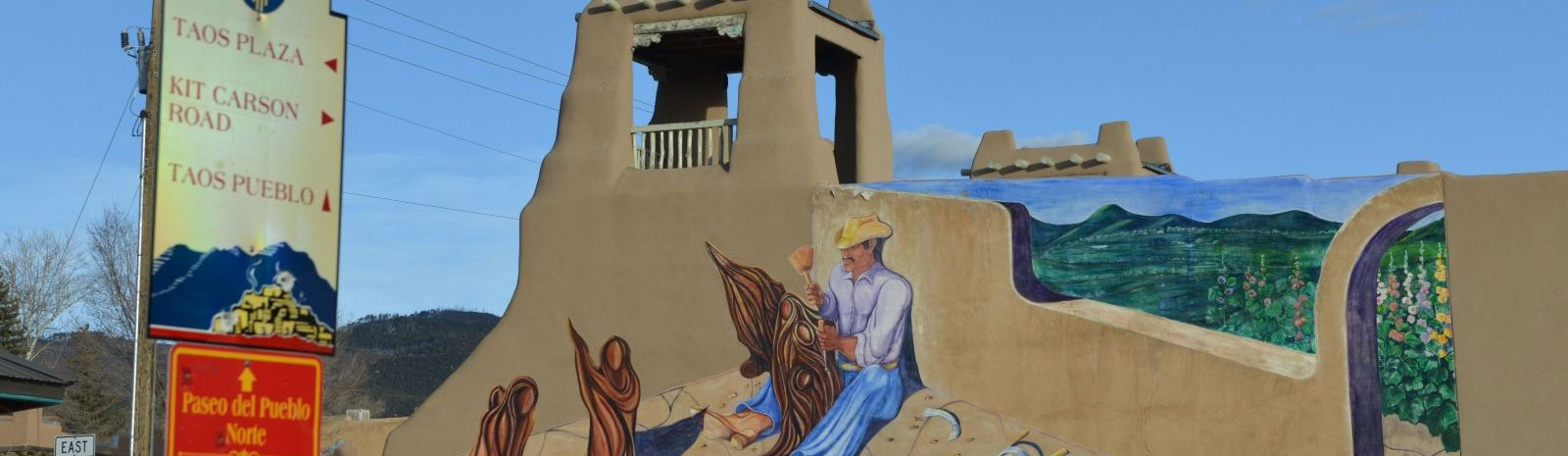

Your success is important to us. Whether you’re starting from scratch or expanding your business, a loan from Centinel Bank will get things moving. We offer our personal attention, local insight and knowledge of Taos County, local processing and decisions, with a full spectrum of lending services for your business to succeed.

We’ve been investing in Taos County since 1969, helping local businesses grow and prosper. We are invested in your success and believe in the power of our local community.

Centinel Bank NMLS #421889.

As Taos' only locally owned and operated community bank we have the flexibility to offer a variety of commercial loan products tailored to meet your unique needs. Our expert lenders are here to help you through the loan process. Contact us today!

The following loan products are available:

- Commercial real estate loans (Purchase, Refinance or Equity loans are available)

- Construction loans

- Short and Long term financing available

- Land development loans

- Equipment loans

- Vehicle loans

- Working capital lines of credit

- Standby letters of credit

- Secured loans

Preparing for your appointment

What are the 5 C's of credit and what can you expect when applying for a commercial loan?

The 5 C’s of credit help assess credit risk and are used by many lenders to evaluate potential borrowers. Knowing about these 5 C’s: character, capacity, collateral, capital, and conditions, and what your bank is looking for will help prepare you to recognize what is most important in a lender’s eyes.

Whether you're starting from scratch or expanding your business, want to buy new equipment, purchase land, improve an existing location, or to just give your business a little breathing room, a loan can help your business in a variety of ways. Knowing what lenders are looking for ahead of time can mean the difference between being accepted or rejected.

Read more about the 5 C's of credit.

To prepare for your appointment with a Commercial Lender, here are a few things to bring:

- Completed business loan application and personal financial statement.

- Income verification: Current year-to-date financial statements (Balance Sheet & Income Statements that).

- Business Tax Returns (most recent 3-years).

- Personal financial statement on each principal owner or guarantor, and most recent 3-years personal federal income tax return.

- Collateral information (i.e. legal descriptions, titles, etc.).

- Other organization documents as described below.

What types of business or organization documents do I need to provide?

Sole-Proprietorship

- Valid Business License, where applicable

- Proper identification for each signer on the loan

Partnership

- Valid Business License, where applicable

- Partnership Agreements

- Partnership Resolution

- Federal Taxpayer Identification Number

- Proper identification for each signer on the loan

Corporation

- Valid Business License, where applicable

- Certificate of Incorporation

- Articles of Incorporation and Bylaws

- Federal Taxpayer Identification Number

- Corporate Resolution – available at bank

- Proper identification for each signer on the loan

Limited Liability Corporation (LLC)

- Valid Business License, where applicable

- Certificate of Organization

- Articles of Organization

- Operating Agreement

- Federal Taxpayer Identification Number

- Proper identification for each signer on the loan